There is a good reason why you have never heard of a forward mortgage. Rarely used outside of comparisons with reverse mortgages, this term refers to conventional mortgages. The choice between a forward mortgage and a reverse mortgage depends on your current personal and financial situation.

A home equity line of credit is the closest alternative to a reverse mortgage for those under 62. (HELOC). This is a fixed sum of money that may be withdrawn at any time and for any purpose. Nonetheless, your residence serves as collateral for a HELOC.

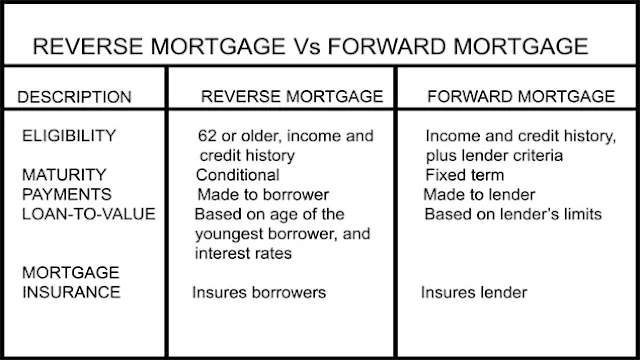

Both forward and reverse mortgages are essentially enormous loans secured by your home, and they represent substantial financial commitments. A couple may use the same home as collateral twice in their lifetime, obtaining a forward mortgage at the time of purchase and a reverse mortgage decades later.

• Reverse and forward mortgages are large loans secured by the borrower's home.

• Forward mortgages, also known as mortgages, are loans used to acquire a residence.

• Reverse mortgages allow homeowners with substantial equity in their home to borrow a lump sum or annuity-like payment if they are at least 62 years old.

• Reverse mortgages do not require monthly payments, and the balance, plus interest, is due upon the borrower's death, sale of the property, or relocation.

Only those 62 and older are eligible for a reverse mortgage.

What is a Reverse Mortgage

The federal government regulates reverse mortgages in order to protect senior citizens from predatory lenders. The government cannot prevent senior citizens from deceiving themselves, however.

At closing, homeowners can receive the entire loan amount in a lump sum with no restrictions on its use. This same expectation is that they will pay off their outstanding debts and supplement their income with any remaining funds. Homeowners may also choose to receive the funds as a monthly annuity or credit line.

When the mortgage holder moves, sells the home, or dies, the accumulated debt and interest on a reverse mortgage, plus fees, are due. This may require the heirs to repay the loan.

There is one consumer-friendly note: the bank cannot demand a payment greater than the home's value. The bank recovers the loss via an insurance fund that was one of the reverse mortgage's costs. In the fall of 2017, the Department of Housing and Urban Development (HUD), that oversees the dominant reverse mortgage program, bolstered this insurance fund.

What is a Forward Mortgage

If they opt for a 10- or 15-year mortgage, borrowers may receive a lower interest rate and save a substantial amount of interest over the life of the loan. However, this requires a fair amount of assurance that your income and expenses will remain stable or improve over the coming years.

The mortgage system is predicated on the premise that real estate appreciates over time. When the housing bubble burst in 2008, this truism was disproved. According to a survey by ATTOM Data Solutions, 2.9% of American mortgaged homes, or one in 34, were "seriously underwater" as of August 2022. Therefore, their owners must continue to pay inflated mortgages or pay their banks 25 percent or more above the assessed value of their homes when they sell.

During the housing boom, it was common for homeowners to obtain a credit line using their home as collateral in addition to their mortgages. The homeowners and their bankers anticipated that the significant appreciation of home values would continue. When the recession hit, homeowners found themselves saddled with mortgage and line of credit debt.

ATTOM Data Solutions, published its U.S. Home Equity and Underwater Report for the second quarter of 2022 in August 2022. It was revealed that underwater properties comprised 2.9% of all mortgaged properties in the United States, a decrease from 3.2% in the 2022 first quarter.

Reverse Mortgage vs Forward Mortgage

Reverse Mortgage vs Forward Mortgage Example

A 30-year-old married couple purchases a home with a modest down payment. They promise to repay the loan in small monthly installments of principal and interest over the course of several years. Thirty years is the conventional norm.

Reverse mortgages have both advantages and disadvantages.

After more than three decades, the same couple continues to reside in the same home, having paid off the mortgage in full. Even with their Social Security benefits and retirement savings, it is difficult for them to make ends meet, so they obtain a reverse mortgage. They will receive a monthly check to supplement their income at no upfront cost. In actuality, they never pay off the mortgage or the accruing interest and costs. However, their descendants must do so in the future, either through the sale of the family home or a lump sum payment.